Accounting is often referred to as the “language of business.” Like any language, it requires compatible rules and guidelines to ensure clear communication. These rules and guidelines are known as accounting standards. They are essential for financial transparency, comparability, and consistency. Whether it’s a multinational corporation or a small business, adherence to accounting standards ensures the morals of financial statements and supports informed decision-making by investors, regulators, and stakeholders.

What are Accounting Standards?

Accounting standards are a set of rules that companies and organizations must follow when recording and reporting financial information. These standards aim to give clear representation of a company’s financial position and allow comparison between different entities.

They serve as the basis for the formation of financial statements and ensure consistency in the terminology, definitions, measurement, and representation of financial data. Without standardized rules, financial reporting varies widely, making it difficult to compare results or assess financial health across organizations.

Accounting standards cover various aspects such as:

- Recognition of revenue and expenses

- Valuation of assets and liabilities

- Presentation of cash flows

- Disclosure requirements

- Treatment of contingencies and provisions

These standards are constantly updated to reflect changes in the economic environment, technological advancements, and emerging financial practices.

Historical Development of Accounting Standards:

In 1939, the American Institute of Accountants (now AICPA) established the Committee on Accounting Procedure. Later, the Financial Accounting Standards Board (FASB) was formed in 1973 to set and update accounting standards in the U.S.

The global movement toward standardization gained momentum with the establishment of the International Accounting Standards Committee (IASC) in 1973, which later became the International Accounting Standards Board (IASB) in 2001. The IASB introduced International Financial Reporting Standards (IFRS) to create a universal language for business affairs.

Over the decades, accounting standards have evolved significantly, shaped by major financial scandals, economic crises, and globalization. For example, the 2008 financial crisis prompted many regulatory bodies to revisit and revise key financial reporting standards to ensure greater transparency and risk disclosure.

Who Started Accounting Standards:

Accounting standards were not invented by a single person, but rather developed over time by various organizations in response to the growing need for consistent, reliable, and comparable financial information.

The evolution of accounting principles has been collaborative, shaped by accountants, auditors, standard-setters, economists, and regulators across the globe. While Luca Pacioli is credited with introducing double-entry bookkeeping in the 15th century, modern accounting standards are the result of decades of institutional efforts to create a unified approach to financial reporting.

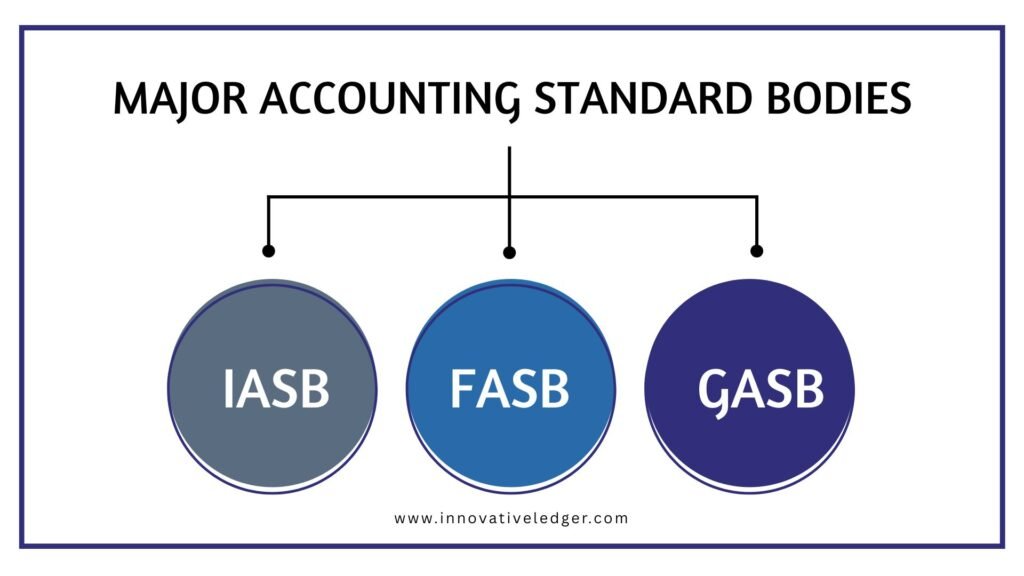

Major Accounting Standards Bodies

Accounting standards are developed, maintained, and enforced by global authorities. These organizations ensure that the financial reporting meets the needs of investors, regulators, and businesses. These are some major accounting standard bodies:

1. International Accounting Standards Board (IASB)

The International Accounting Standards Board (IASB) develops and maintains International Financial Reporting Standards (IFRS), aiming to create a single set of high-quality, globally consistent accounting standards.

The IASB is based in London and works under the IFRS Foundation. It creates accounting standards that are flexible but consistent. Over 140 countries use these standards, including many in Europe, Asia, and South America. Although the US has its own standards, the IASB works with them to make accounting rules similar worldwide. This helps companies and investors work more easily across borders.

The IASB continuously revises IFRS to address emerging issues such as sustainability reporting, cryptocurrency accounting, and fair value measurement. It engages in extensive consultations with stakeholders and encourages global convergence in accounting practices.

2. Financial Accounting Standards Board (FASB)

The Financial Accounting Standards Board (FASB) is responsible for setting and improving accounting standards in the US, known as Generally Accepted Accounting Principles (GAAP). Founded in 1973, FASB operates independently to ensure financial reporting provides useful information to investors and stakeholders.

Its standards offer detailed guidance for accounting practices, aiming to reduce ambiguity. FASB collaborates with the International Accounting Standards Board (IASB) to align US GAAP with global standards (IFRS), enhancing comparability for global investors. Through joint projects and updates, FASB promotes consistency and clarity in financial reporting, supporting informed decision-making.

FASB also oversees the development of the Accounting Standards Codification (ASC), which organizes U.S. GAAP into an accessible structure, making it easier for practitioners to locate and apply the correct standards.

3. Governmental Accounting Standards Board (GASB)

The Governmental Accounting Standards Board (GASB) is an independent organization that develops accounting standards for U.S. state and local governments. Established in 1984, GASB operates under the oversight of the Financial Accounting Foundation (FAF).

Its standards, known as Generally Accepted Accounting Principles for State and Local Governments, focus on the unique needs of the public sector, emphasizing fund accounting, budgetary compliance, and fiscal accountability.

GASB’s standards guide financial reporting for public institutions, such as cities, counties, school districts, and public utilities, ensuring clarity, consistency, and comparability. By engaging stakeholders through public exposure drafts and comment periods, GASB promotes transparency and trust in public sector financial reporting, enabling informed decision-making about public funds.

Other Notable Standards Bodies:

- International Federation of Accountants (IFAC): A global organization for the accountancy profession, promoting high-quality standards and ethical practices.

- Accounting Standards Board (ASB – India): Sets accounting standards in India, under the Institute of Chartered Accountants of India (ICAI).

- Canadian Accounting Standards Board (AcSB): Oversees standards for private enterprises, public sector entities, and not-for-profits in Canada.

Application of Accounting Standards: Who Must Follow Them

Accounting standards apply to a wide range of entities across different sectors. The scope includes but is not limited to:

- Public Companies: Listed on stock exchanges and subject to regulatory requirements for transparent financial reporting.

- Private Companies: Often required by lenders, investors, or regulatory agencies to maintain financial standards.

- Government Entities: Must follow standards like those issued by GASB to report public finances responsibly.

- Financial Institutions: Including banks and insurance companies, which must present detailed and reliable financial data.

- Non-profit Organizations: Must follow specific standards to maintain accountability and donor trust.

- Multinational Corporations: Operate across borders and need to prepare financial statements using IFRS or a reconciled standard.

- Small and Medium Enterprises (SMEs): May follow simplified versions of IFRS or local GAAP to ensure compliance.

- Auditors and Accounting Professionals: Must apply accounting standards when preparing and reviewing financial records.