In the financial world, investors, regulators, and stakeholders depends on exact and standardized financial reports to evaluate the potential outcomes. That’s where US GAAP (Generally Accepted Accounting Principles) comes in. GAAP principles provide the foundation for financial accounting and reporting in the United States. They ensure that financial statements are prepared using uniform guidelines, enabling comparability across different companies and industries.

What is US GAAP?

US GAAP are accounting principles, standards, and procedures that companies in the United States must follow when compiling their financial statements. It is the accounting framework adopted by the Securities and Exchange Commission (SEC) for public companies and is widely used by private entities, non-profits, and government organizations. These principles are primarily established by the Financial Accounting Standards Board (FASB).

History of US GAAP:

US GAAP has evolved over a century, responding to financial crises, market needs, and regulatory reforms.

Pre-1929: Early Accounting Practices

Before the 1929 stock market crash, there were no formal accounting standards in the US. Companies had significant freedom in reporting financial information, leading to inconsistent and unreliable financial statements.

1929-1934: The Great Depression and Birth of Financial Regulation

The Great Depression shook public confidence in capital markets. In response, the US Congress passed key legislation, including the Securities Act of 1933 and Securities Exchange Act of 1934, creating the SEC.

1939-1959: Committee on Accounting Procedure (CAP)

CAP issued Accounting Research Bulletins but faced challenges, including limited authority and inconsistent application.

1973-Present: Financial Accounting Standards Board (FASB)

FASB has served as the primary standard-setter for US GAAP and launched the FASB Accounting Standards Codification in 2009.

Organizations Involved in US GAAP

Several entities contribute to the development and maintenance of US GAAP:

- Financial Accounting Standards Board (FASB): The primary body responsible for issuing new accounting standards.

- Securities and Exchange Commission (SEC): Oversees public companies and ensures they comply with GAAP in their financial filings.

- American Institute of Certified Public Accountants (AICPA): Provides guidelines and supports accounting professionals.

- Governmental Accounting Standards Board (GASB): Sets GAAP for state and local governments.

- Public Company Accounting Oversight Board (PCAOB): Oversees audits of public companies and enforces compliance with accounting standards.

Principles of US GAAP

US GAAP is grounded in several core principles that form the foundation for all accounting standards:

1. Economic Entity Assumption

The business is treated as a separate entity from its owners or other businesses.

2. Monetary Unit Assumption

Only transactions that can be expressed in monetary terms are recorded.

3. Time Period Assumption

Financial reports are prepared for specific periods such as quarterly or annually.

4. Cost Principle

Assets are recorded based on their original cost rather than current market value.

5. Revenue Recognition Principle

Revenue should be recognized when it is earned, not necessarily when payment is received.

6. Matching Principle

Expenses should be matched with the revenues they help generate in the same period.

7. Full Disclosure Principle

All relevant financial information should be disclosed in the financial statements.

8. Going Concern Principle

It is assumed that the business will continue to operate unless evidence suggests otherwise.

Key Elements of Financial Statements Under US GAAP

US GAAP outlines the preparation of the following main financial statements:

1. Balance Sheet

Shows the company’s assets, liabilities, and equity at a specific point in time.

2. Income Statement

Details revenues, expenses, and profits or losses over a period.

3. Statement of Cash Flows

Shows cash inflows and outflows from operating, investing, and financing activities.

4. Statement of Shareholders’ Equity

Illustrates changes in owners’ equity during a reporting period.

Each of these statements must be prepared using specific formats and principles dictated by US GAAP.

Structure of US GAAP

The US GAAP framework is organized into a system known as the FASB Accounting Standards Codification (ASC). The ASC was launched in 2009 to simplify and streamline access to authoritative GAAP.

The codification is divided into the following hierarchy:

- Topics (e.g., Revenue, Leases, Financial Instruments)

- Subtopics (e.g., Recognition, Measurement)

- Sections (e.g., Initial Measurement, Subsequent Measurement)

- Paragraphs (detailed accounting guidance)

This structure makes it easier for accountants and financial professionals to locate relevant guidance efficiently.

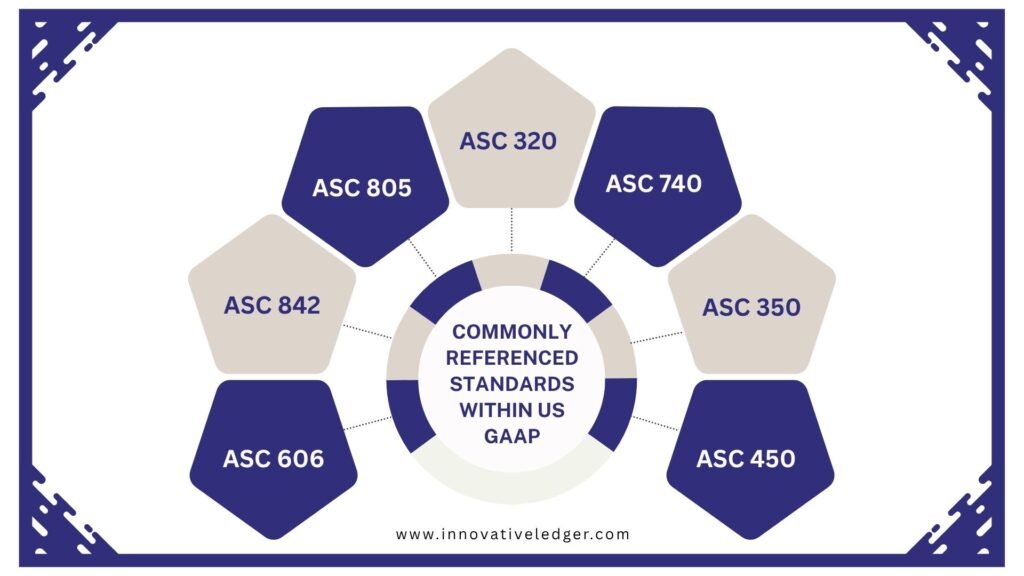

Common US GAAP Standards

Here are some commonly referenced standards within US GAAP:

- ASC 606: Revenue from Contracts with Customers

- ASC 842: Leases

- ASC 805: Business Combinations

- ASC 320: Investments in Debt and Equity Securities

- ASC 740: Income Taxes

- ASC 350: Intangibles – Goodwill and Other

- ASC 450: Contingencies

Each standard includes detailed rules and examples for proper implementation.

Benefits of Using US GAAP

Adhering to US GAAP provides several key advantages:

- Investor Confidence: Enhances trust in the financial health of companies.

- Credibility: Lenders and creditors view GAAP-compliant financials as more reliable.

- Legal Compliance: Ensures compliance with SEC regulations for public companies.

- Better Decision-Making: Provides accurate data for business analysis and planning.

The Future of US GAAP

Efforts to converge US GAAP and IFRS have been ongoing for years. While complete convergence has yet to be achieved, several joint projects between the FASB and IASB have led to aligned standards in areas such as revenue recognition and leases.

In the future, US GAAP will likely continue evolving to address emerging issues like:

- Cryptocurrency accounting

- Sustainability and ESG disclosures

- Technology and digital assets

- Global harmonization pressures